It is November 2024. We just heard that ImseVimse has gone bankrupt. Another company that was active in the cloth diaper industry for more than 10 years has fallen. Unfortunately, the news no longer surprises us. In one year, TotsBots, Close, Anavy and many other smaller brands and retailers ended this way. How could this happen when the cloth diaper market was doing so well?

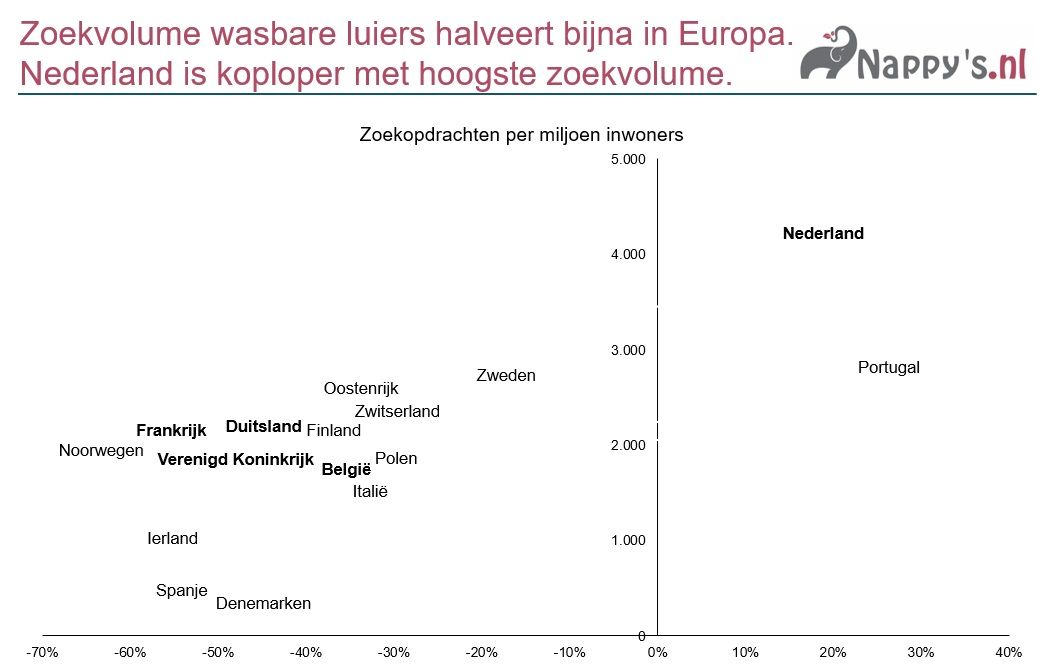

After strong growth in the years up to and including 2021, we notice in the summer of 2022 that the growth has stopped. During this period, we suddenly receive regular emails from suppliers complaining about the poor market conditions. We investigate and what we find surprises us. Google keyword data shows that only the Netherlands and Portugal had good market conditions up to and including mid-2022. In other countries, the market peaked in 2020 and has had a lower search volume since then. But another striking conclusion is that the search volume in the Netherlands per million inhabitants is twice as high as in most other countries in Europe. Although we, as the reusable diaper industry in the Netherlands, like to believe that other countries are leading the way with government subsidies, effective partnerships and having their own production industry, it turns out that in the Netherlands, we are further ahead than in all other European countries when it comes to the awareness and use of reusable diapers.

The graph (written in Dutch) above shows the development of the search volume for reusable diapers in % mid-2022 compared to mid-2019 and the absolute number of searches per million inhabitants per country mid-2022. The most important European sales markets are shown in bold.

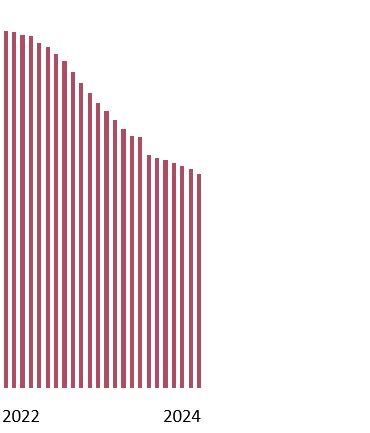

But our main conclusion from this research is that the market is in a much worse state than we thought shortly before. It explains the rush of emails from suppliers, because Europe's largest sales markets all show a halving of the search volume, which is an important indication of decreasing interest and demand for new reusable diapers.

The market for disposable diapers

An additional challenge for the reusable diaper market is the fragmentation and the number of new entrants. The number of disposable diaper brands can be counted on one hand. Pampers is the dominant player, Huggies is lagging behind and then you have the newer brands such as Lillydoo and The Honest Company that want to distinguish themselves with a more sustainable image. But Lillydoo's last two annual accounts show that the company has shown a decline in turnover in both 2021 and 2022. In 2022, it made a loss of €14 million on a turnover of €57 million, which means that the company now has negative equity. The Honest Company went public in 2021. Two years later, the share price had fallen by 90%. This shows that it is difficult to break the dominant position of Pampers as a brand on the one hand and the private labels such as Kruidvat, Albert Heijn and Etos on the other. Lillydoo and The Honest Company offer convenience (with subscriptions) and a good feeling (eco-friendly diapers, although research shows this to be a marginal difference and can also be seen as greenwashing), but the price premium they ask for this is high. And with the energy and inflation crisis of 2022, it has proven difficult to convince customers that they are worth this price premium. Of course, all the research that indicates that something like a sustainable or eco-friendly disposable diaper does not actually help with sales.

Even in the world of disposable diapers, it’s hard to make money. Pampers makes money, a lot of it. Huggies also makes money. The rest, actually, not. Private label manufacturers live on low margins and the diaper sellers never make money on disposable diapers, whether they’re Pampers diapers or private label diapers. It’s mainly used as a tool to attract young families as customers, because these customers can use a lot of other supermarket or drugstore products as a young family.

Disposable diapers have a market share of approximately 95% in Europe today. The number of brands can be counted on one hand and there are actually only two companies with a stable healthy profitability. The reusable diaper market has a market share of approximately 5%. The number of brands available in the Netherlands is approximately 50. That is a multiple of the number of disposable diaper brands, while the market is twenty times smaller. The number of specialized web shops that focus on the sale of reusable diapers is higher than the number of specialized web shops that focus on the sale of disposable diapers. With reusable diapers, when you buy a complete package, it is one purchase and after that you will not see the customer again in most cases. At most for a loss-making order for a box of inserts. With disposable diapers, customers keep coming back for years and ultimately spend more because disposable diapers are simply more expensive than reusable diapers in the long run. If you add up all these variables, you cannot help but conclude that the reusable diaper industry has a mega-large scale problem. Every company in this industry suffers from it. As an industry, we are simply too small to bear the costs of good logistics, a good website, good service and good marketing. And you can see that. If you look closely, you will see that many reusable cloth diaper brands and webshops have shortcomings in at least one of these aspects.

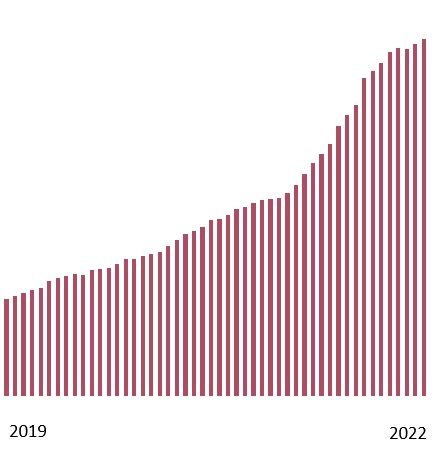

The development in the Netherlands from 2019

In the period 2019 to 2022, the number of companies active in the reusable diaper industry will increase rapidly. We already mentioned in our previous blog that several brands were added in the Netherlands, this trend was visible worldwide. In the beginning, new brands are still embraced, but at the end of the period it is clear that there is no more room for new brands. Retailers hardly add any new brands. Because it adds little to what is already there and because there is no more money to finance a stock of yet another brand. The result is that many start-up brands do not really get off the ground. But the diapers have all been made and the brands want to sell. There is more advertising and a lot of discounts are given to still get customers and liquidity. Discounts of 50% are no longer rare. Since the margins in the reusable cloth diaper industry are limited, it is not possible to run a sustainably profitable business with these discounts. It is a last-ditch attempt to still get money to pay salaries, rent and taxes.

Picture: Instagram feed TotsBots around 2023

Picture: Instagram feed TotsBots around 2023

Consumers will also be keeping a tight rein on their spending from 2022 onwards due to the energy and inflation crisis resulting from the war in Ukraine. As a result, there will be more interest in second-hand reusable diapers. Because many new diapers were sold in the peak period 2 years before, there is a large supply of second-hand reusable diapers from children who have just become potty trained. While the price of second-hand diapers in 2020 was often 80% of the new price, it is now less than 40%. There is simply too much supply for the demand. The low price for second-hand reusable diapers puts extra pressure on the sale of new diapers. Because while many parents opt for new diapers at a 20% discount on second-hand diapers, this is different at a 60% discount or more. The low price point makes second-hand diapers even more interesting. As a result, the sale of new diapers is coming under increasing pressure. Our suppliers are already selling significantly less to consumers and retailers in 2022 than in previous years and we are going to notice that.

The problem is spreading rapidly. In 2023, there are dozens of brands and sellers trying to survive in the same way. Consumers can find discounts in many places, so the effectiveness of discount promotions is limited. The ever-lower second-hand prices naturally contribute to this. Customers have more and more alternatives. Due to all the new entrants and the fierce competition from both new and second-hand diapers, there is so much choice in reusable diapers that giving a lot of discounts is not really a solution for many companies.

A side effect of all this is the decreasing number of collections. Companies no longer have the financial resources to invest in a new collection and also still have too much old stock. Every now and then a new product or a new collection comes out, but sometimes not for months. There are brands that have not launched anything new for years, even brands that used to launce with a new collection every month. And that is a shame, it means less choice of new diapers and fewer moments that the reusable cloth diaper is put in the spotlight. This is why it is disappearing more and more out of the picture.

Due to the large number of entrants in the previous years and the halving of demand, the situation arises that we are active with twice as many companies in a market that is half as small. That can only end in a bloodbath, and unfortunately that is what happens.

The bloodbath

In November 2023, shocking news comes from the UK when two long-standing companies go bankrupt at the same time. TotsBots and Close Parent will not make it. Dozens of people lose their jobs overnight. TotsBots was sold back to its old management a few months before the bankruptcy, but it was too late to turn the tide. Customers, retailers and other brands are shocked, but many insiders should not be surprised. It is the result of a miserable combination of falling demand and falling sales prices combined with rising operational costs and an extremely competitive market situation with too many suppliers in relation to the size of the market. In addition to TotsBots and Close, Anavy, a Czech manufacturer that made its name with the most absorbent night diaper on the market, is also closing down this month.

Shortly before this, we had made an analysis in which we came to the conclusion that we were concerned about the survival of half of all our suppliers. We recently did it again. Unfortunately, we now have to conclude that we are now concerned about the future of 75% of our suppliers. New bankruptcies are lurking in the cloth diaper industry. And perhaps this is also the only way out in the short term, because it offers air to the remaining players (unless companies make a fresh start, which is also happening).

Financial results

For years, we have been monitoring the financial performance of companies in the reusable diaper industry. Brands, retailers and distributors with a B.V., or similar foreign legal form, file their annual accounts annually, which provides insight into their financial development. Because these are often small companies, only a balance sheet can be found for most companies. Larger companies must also file a profit and loss account.

Of the larger companies with a profit and loss account, all had a decline in turnover in the last reporting year (usually 2023). Most of them also in the previous year.

An operational result (profit before interest costs and taxes) can be seen for eight of the twenty companies examined. Of these companies, 75% are loss-making, including the largest companies in this sector. The small companies that are still making a profit have lower results than in previous years.

If we look at the balance sheet development, we see that 85% of companies show a net decrease in equity over the past two financial years. Although a decrease in equity does not necessarily indicate a loss-making situation, it is very plausible. The 15% that does not show a decrease in equity largely consists of companies that have not yet filed their annual accounts for 2023. At the moment, there are a striking number of companies that are late in filing their annual accounts, which is usually not a good sign. The above figures could therefore become (or are) even worse.

The result of this development in results is that almost every company in the reusable diaper industry has switched to a kind of survival mode. There is hardly any investment in product development, marketing or improving the webshop. And with that, a sudden growth in demand for reusable cloth diapers is not to be expected.

More offline visibility

Unfortunately, the increase in the number of sales outlets for reusable diapers in recent years has not led to an increase in demand for reusable diapers. It was often thought that if cloth diapers were clearly visible because they were on display in baby specialty stores and supermarkets, sales of reusable diapers would automatically increase. We have never believed in this, because in other European countries where this was the case, the popularity of reusable diapers was actually lower than in the Netherlands. Reusable diapers are a knowledge-intensive product. If you just hang them up in a store, boxes will be opened, people will touch them, and the diapers will not be neatly hung back up. The result is a messy shelf with an unattractive, messy product. We experienced this ourselves when we sold our stuff on a shelf in a store for a while. Few sales, but it always looked messy when we went to look. And the people in the store cannot help you with your questions about reusable diapers. You can still experience all this today if you walk into any Baby-Dump or HEMA. The reusable diaper is not helped by this kind of exposure, which has unfortunately been proven again in recent years.

Picture: Reusable diaper shelf in a major retail chain

Another problem with reusable diapers in large retail chains such as Kruidvat, HEMA or Baby-Dump is that they usually show leak-prone diaper. Made of leak-prone materials and executed in the most leak-prone system. Not entirely coincidentally, this is also the cheapest way to produce a reusable diaper. The price point in these retail chains is therefore low and that in turn influences the perception of what a reusable diaper should cost. However, the quality is also low and that leads to many negative experiences with reusable diapers, causing parents to drop out. The sale of reusable diapers in stores has thus damaged the concept of cloth diapers. It is a specialist product that requires specific knowledge and that can only be found with specialists. Several retailers are already stopping with reusable diapers because of the above-mentioned problems; too much hassle and too few sales. Ultimately, this is a positive trend, although in the short term there is only damage due to an oversupply of cheap and leak-prone diapers.

Where does this decline come from?

The most important question that we have not yet addressed is of course; why has the popularity of reusable diapers declined in recent years? And to be honest, we do not have the answer. We see that it is a global problem. Things were going well everywhere at the beginning of the corona period, but demand then collapsed. A downward trend that has been going on for years now. There does not seem to be a really good reason. The advantages of reusable diapers are still very strong. You still save a lot of money and it has been proven that it is better for the environment. It is also more pleasant for your child and it is a good way to guide your child to toilet training sooner.

Perhaps the focus on doing something good for the environment has waned somewhat. We see that these problems do not only occur with reusable diapers, but also with other sustainable products. Or it is because there are now so many high-quality reusable diapers in circulation that much more is bought and sold second-hand, which means there is less demand for new products. In that case, the room to maneuver for companies that sell new products is by definition a lot smaller than before, even if the market were to stabilize.

In any case, we can conclude that as an industry we have not yet succeeded in getting the masses to use reusable cloth diapers. Many people are still afraid of the amount of work (changing and washing) or are afraid that it is dirty or unhygienic. The real reusable diaper fan knows that this is all not true, and that you earn back the extra time for washing, drying and folding because your child is toilet trained on average one year earlier. Unfortunately, most people are not yet convinced of this.

And now?

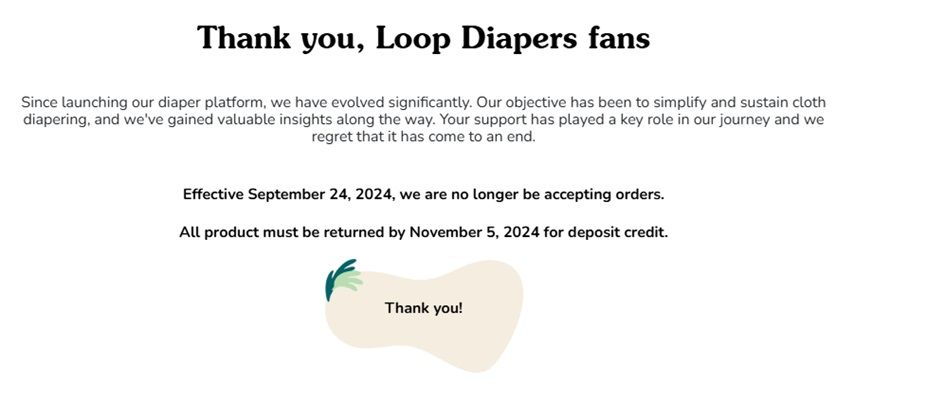

It is November 2024. Pampers pulls the plug on the Loop Diapers project. With this project they launched reusable diapers (from the brand Charlie Banana acquired in 2020) including a laundry service. Dirty diapers were picked up at home and exchanged for clean diapers. The service was offered in all states of the United States so that it could be promoted nationwide. Pampers had the infrastructure and resources to continue to focus on this, but is closing it due to a lack of sufficient interest. Where Pampers feared missing the boat a few years ago, the reusable cloth diapers unfortunately now appear not to be necessary in its strategy. And there are only a few people who will hold Pampers accountable for that.

Picture: Goodbye message of the website from Loop Diapers

The cloth diaper industry is clearly in an unhealthy and unsustainable situation. This will undoubtedly lead to adjustments in the coming years. Cloth diaper companies will go bankrupt or voluntarily close down. As a consumer, you run the risk of buying something from a brand or retailer that goes bankrupt, meaning you can no longer rely on the right of return or warranty. And if you are really unlucky with your timing, you may even end up paying for an order that is never delivered.

In the past 25 years that the modern reusable diaper has existed, we have experienced a crisis like this a few times before. The peak was a lot higher this time, which means that the valley is also a lot deeper. To be fair, this young industry is suffering, but in the end we will emerge more mature and stronger, which is always the case with every crisis. With fewer, but stronger companies. And then we will simply try again to steal some market share from that polluting disposable diaper ;-)